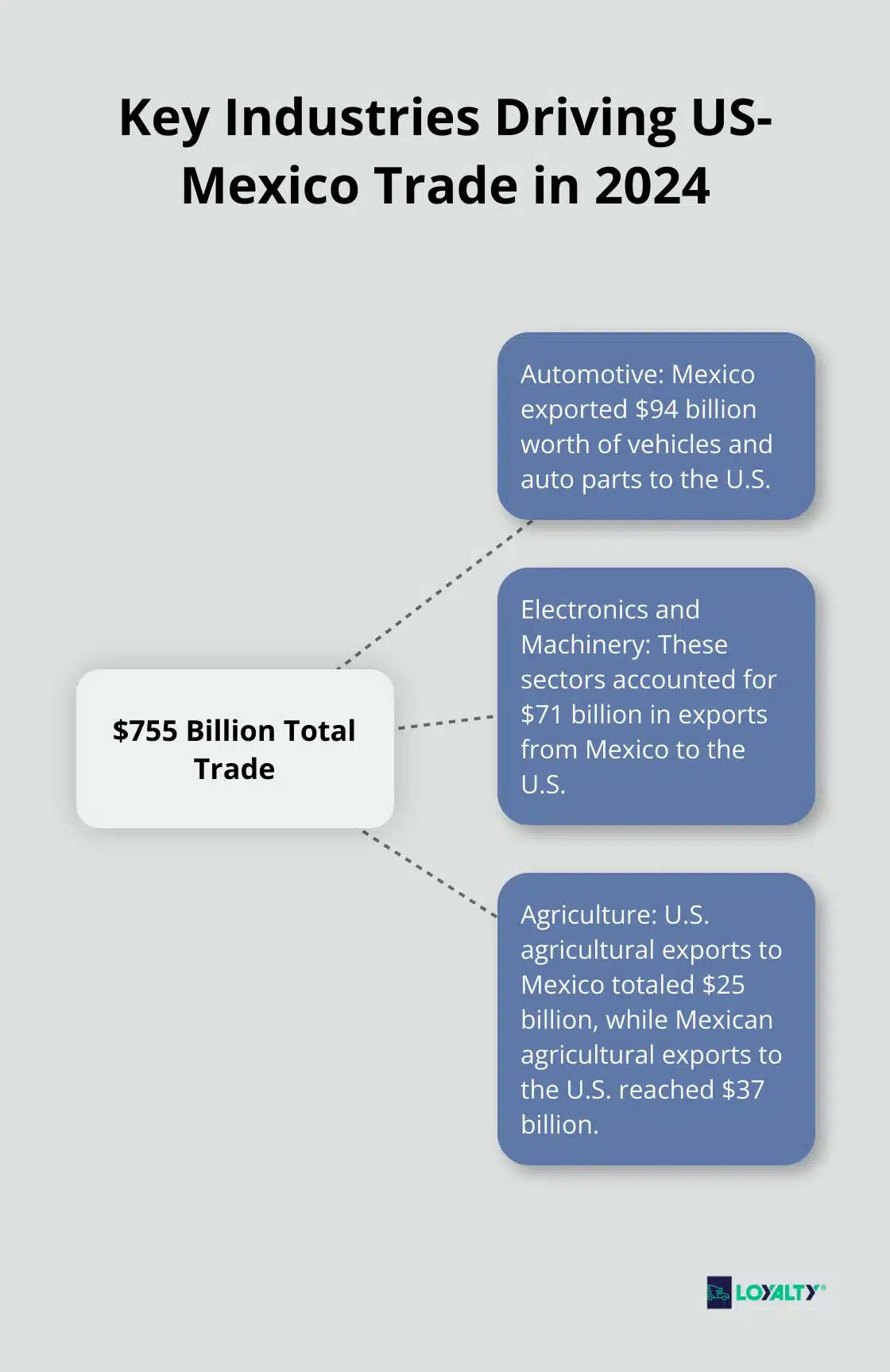

The Magnitude of Bilateral Trade

The United States and Mexico maintain one of the world’s most significant bilateral economic partnerships. In 2024, the total trade volume between these nations reached $755 billion (U.S. Census Bureau). This figure highlights the deep economic ties that connect these neighboring countries.

Key Industries Driving Cross-Border Commerce

Several sectors dominate the US-Mexico trade landscape:

- Automotive: Mexico exported $94 billion worth of vehicles and auto parts to the U.S. in 2024.

- Electronics and Machinery: These sectors accounted for $71 billion in exports from Mexico to the U.S.

- Agriculture: The U.S. Department of Agriculture reports that Mexico is the largest export market for U.S. corn, soybeans, and dairy products. In 2024, U.S. agricultural exports to Mexico totaled $25 billion, while Mexican agricultural exports to the U.S. reached $37 billion (dominated by fresh produce like avocados, tomatoes, and berries).

To understand the full scope of trade between these nations, explore our detailed analysis of what the US exports to Mexico.

USMCA: A New Era in North American Trade

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA in 2020, reshaped trade relations. This agreement introduced stricter rules of origin for the automotive industry, requiring 75% of auto content to be made in North America to qualify for duty-free treatment. Many manufacturers responded by reassessing their supply chains and increasing North American sourcing.

The USMCA also modernized intellectual property protections and introduced new labor provisions. It mandates that 40-45% of auto content be made by workers earning at least $16 per hour, a move that tries to level the playing field between U.S. and Mexican workers.

The Evolution of US-Mexico Tariffs

Tariffs between the U.S. and Mexico have a complex history. Before NAFTA in 1994, average tariffs on U.S. exports to Mexico were around 10%, while Mexican exports to the U.S. faced an average tariff of 4% (Congressional Research Service).

NAFTA eliminated most of these tariffs, leading to a surge in bilateral trade. However, recent years saw a resurgence of tariff threats. In 2019, the U.S. threatened to impose escalating tariffs on all Mexican imports (starting at 5% and potentially rising to 25%) in response to immigration concerns. While these tariffs were not implemented, they highlighted the potential use of trade measures as leverage in non-trade issues.

The current average tariff rate between the U.S. and Mexico under USMCA is near zero for most goods. However, certain products still face tariffs. For example, some agricultural products are subject to tariff-rate quotas, where a specified quantity can enter duty-free, but additional imports face higher tariffs.

Understanding these trade dynamics proves essential for businesses operating in the North American market. Companies must stay informed about these evolving trade relations to make strategic decisions about sourcing, manufacturing, and distribution across North America. For comprehensive guidance on navigating these complexities, our complete guide to cross-border shipping provides valuable insights.

As we move forward, it’s important to examine how these tariffs and trade agreements directly impact businesses and consumers on both sides of the border. The next section will explore the specific effects of tariffs on US-Mexico trade, including changes in import/export costs and shifts in manufacturing and supply chains.

How Tariffs Reshape US-Mexico Trade Dynamics

The Ripple Effect on Import and Export Costs

Tariffs between the United States and Mexico significantly increase the cost of goods crossing the border. The U.S. Chamber of Commerce calculated that a 25% tariff threat in 2019 would have added $87 billion in costs to U.S. imports from Mexico. Even smaller tariffs can have a substantial impact. A 5% tariff on Mexican imports would cost U.S. consumers $17 billion annually (as estimated by the Trade Partnership Worldwide LLC). These increased costs often result in higher prices for consumers or reduced profit margins for businesses, depending on who absorbs the additional expense.

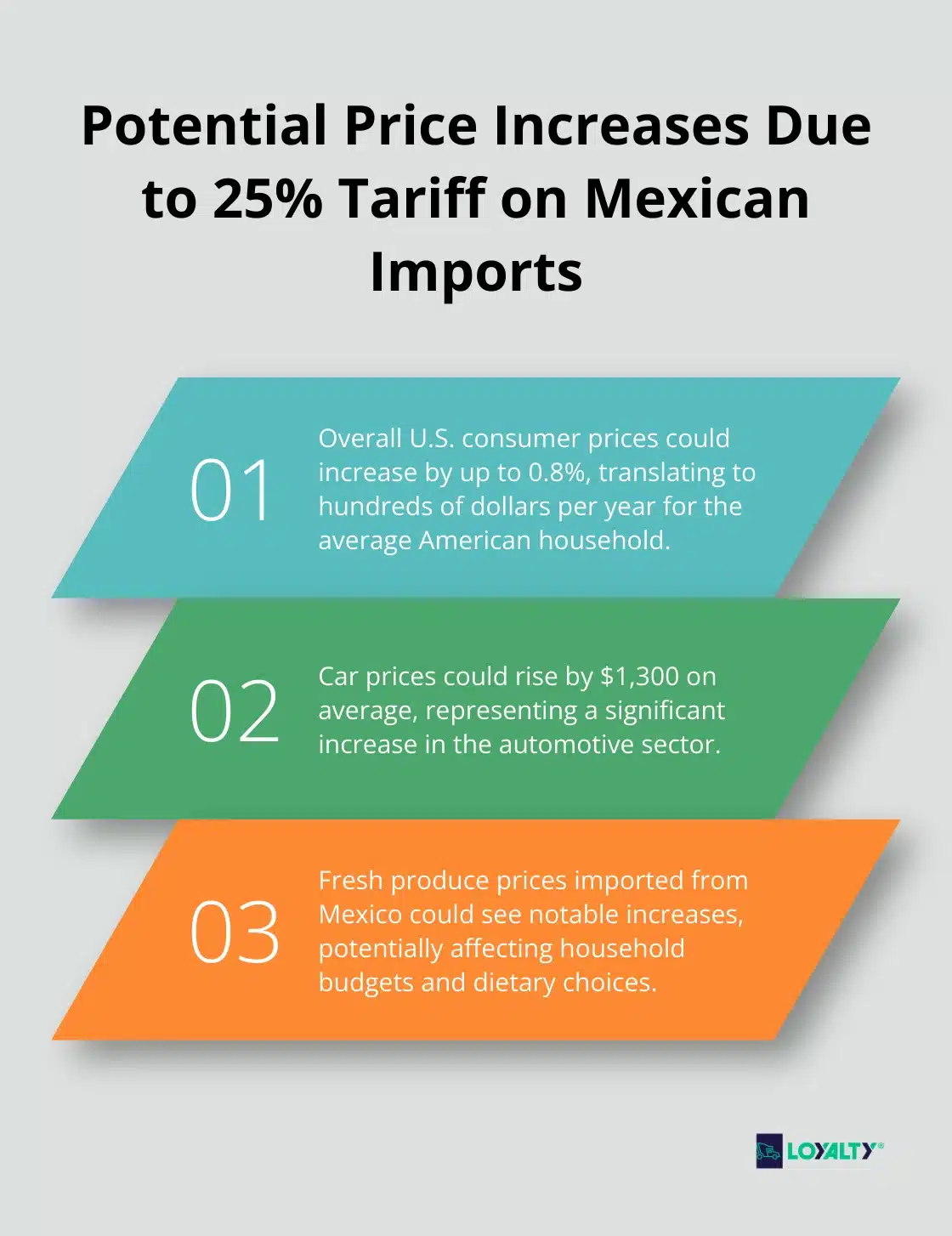

Price Fluctuations in the Consumer Market

Tariffs typically lead to higher prices for consumers. The Peterson Institute for International Economics projects that a 25% tariff on all Mexican imports could increase U.S. consumer prices by up to 0.8%. This translates to hundreds of dollars per year for the average American household.

Certain industries are particularly vulnerable to these price increases:

- Automotive: U.S. consumers could see car prices rise by $1,300 on average if a 25% tariff were applied to Mexican auto imports (according to Deutsche Bank estimates).

- Fresh produce: Prices for fruits and vegetables imported from Mexico could see notable increases.

- Electronics and machinery: These sectors could also experience price hikes, directly impacting household budgets.

Reshaping Manufacturing and Supply Chains

Tariffs often prompt companies to reevaluate their supply chains and manufacturing strategies. Some U.S. companies have shifted production back to the United States or to other countries to avoid tariffs, while others have absorbed the costs or passed them on to consumers.

The automotive sector (which accounts for 30% of U.S.-Mexico trade) provides a clear example of this impact. Manufacturing companies in this space need specialized industrial manufacturing logistics solutions to adapt to these changing dynamics. The Center for Automotive Research estimates that U.S. auto production costs could increase by $3,000 per vehicle if significant tariffs were imposed on Mexican imports.

Employment Shifts and Economic Impact

The job markets in both countries feel the effects of tariff changes. While protectionist measures aim to boost domestic employment, the reality is often more complex. The U.S. Chamber of Commerce estimates that 5 million U.S. jobs depend on trade with Mexico. Disruptions to this trade relationship could put many of these jobs at risk.

In Mexico, tariffs could lead to job losses in export-oriented industries. The Mexican automotive industry (which employs over 900,000 people) would be particularly vulnerable. Conversely, some U.S. manufacturing sectors might see job growth if production shifts away from Mexico.

However, these job market shifts aren’t always straightforward. Higher consumer prices resulting from tariffs can reduce overall demand, potentially leading to job losses in other sectors of the economy.

Companies must stay informed about potential tariff changes and prepare to adapt their strategies accordingly. This might involve diversifying supply chains, exploring new markets, or investing in technology to improve efficiency and offset increased costs. The next section will explore specific strategies businesses can employ to navigate these complex tariff landscapes effectively.

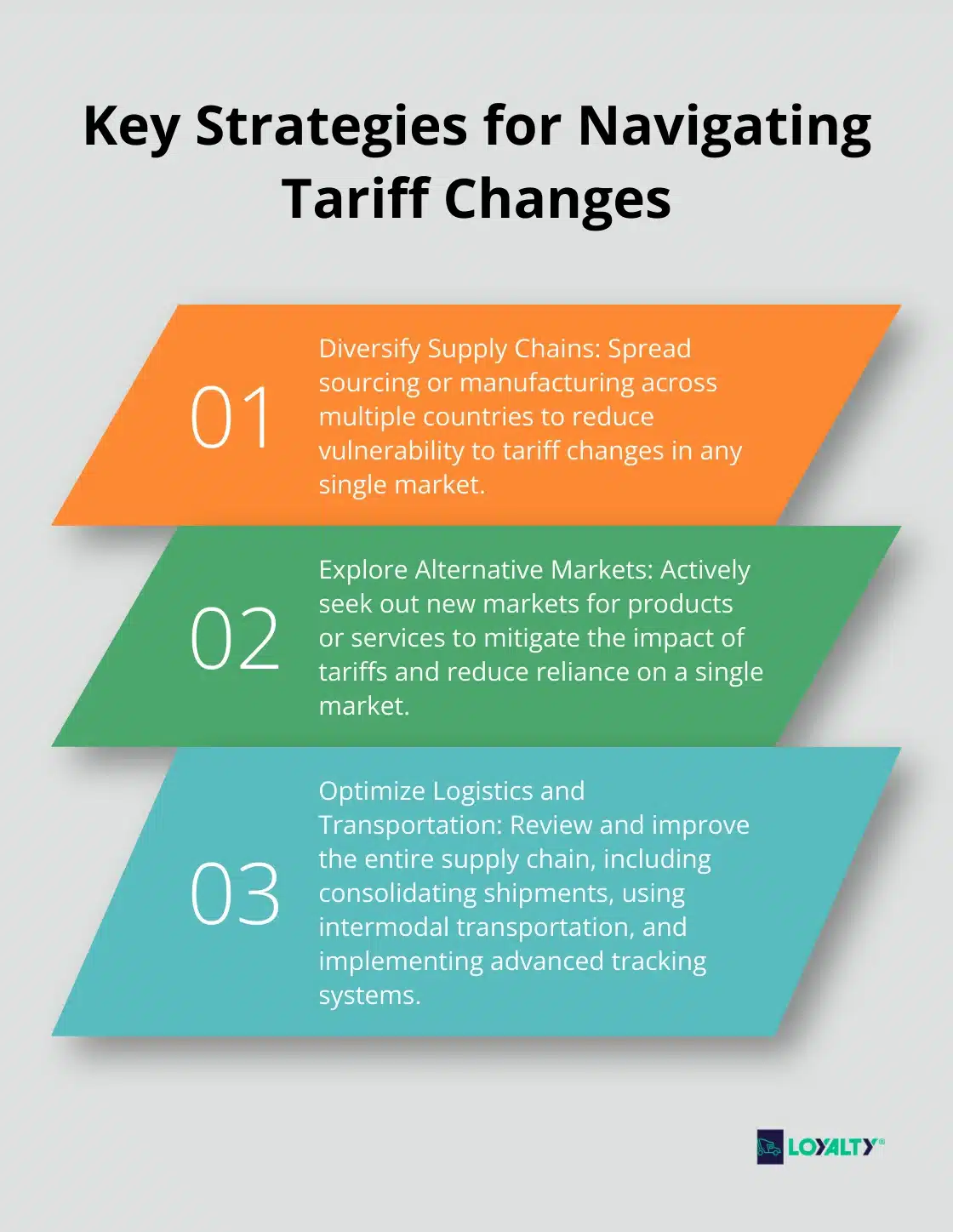

Strategies for Businesses to Navigate Tariff Changes in US-Mexico Trade

Diversify Supply Chains

Companies that rely heavily on Mexican imports or exports should spread their sourcing or manufacturing across multiple countries. This strategy reduces vulnerability to tariff changes in any single market.

A U.S. auto parts manufacturer that previously sourced 80% of its components from Mexico might now opt for a more balanced mix: 40% from Mexico, 30% from the U.S., and 30% from other countries like Vietnam or Malaysia. This diversification can help mitigate the impact of potential tariffs while also opening up new opportunities in emerging markets.

Explore Alternative Markets

Businesses should actively seek out new markets for their products or services. If tariffs make Mexican goods less competitive in the U.S. market, Mexican companies might focus more on European or Asian markets. Similarly, U.S. companies facing higher costs for Mexican imports might explore domestic alternatives or look to other countries for similar products.

The agricultural sector provides a concrete example. When faced with potential tariffs on Mexican avocados, some U.S. retailers increased their sourcing from California and Peru. This shift not only helped manage costs but also reduced reliance on a single source.

Optimize Logistics and Transportation

Efficient logistics can offset some of the costs associated with tariffs. Companies should review their entire supply chain for optimization opportunities. This might involve:

- Consolidation of shipments to reduce the number of border crossings

- Use of intermodal transportation to leverage the most cost-effective methods

- Implementation of advanced tracking systems to minimize delays and associated costs

During these complex trade periods, working with freight brokers who understand tariff implications becomes even more valuable for optimizing your shipping strategy.

Leverage Technology and Data Analytics

Advanced technology and data analytics play a crucial role in navigating tariff changes. Companies should invest in systems that provide real-time visibility into their supply chains and can quickly model the impact of potential tariff scenarios.

A manufacturer using AI-powered supply chain software can run simulations to understand how different tariff rates would affect their costs and profitability. This allows for more informed decision-making and faster responses to policy changes. Integrating sustainable supply chain practices with these technological solutions can provide long-term competitive advantages while managing tariff impacts.

Engage in Strategic Partnerships

Formation of strategic partnerships can provide a competitive edge in a challenging tariff environment. This might involve:

- Collaboration with suppliers to share the burden of increased costs

- Partnerships with companies in complementary industries to create more integrated, cost-effective solutions

- Work with logistics providers who have expertise in navigating complex trade regulations

These partnerships can lead to innovative solutions that might not be possible for a single company acting alone. For instance, a U.S. electronics company partnering with a Mexican manufacturer might restructure their production process to qualify for preferential treatment under USMCA rules.

Companies should conduct thorough cost-benefit analyses and stay informed about the latest developments in trade policy. A proactive approach to managing tariff-related challenges can help businesses thrive in the dynamic landscape of US-Mexico trade. Professional freight services that understand these complexities can be invaluable partners in this process.

Final Thoughts

Tariffs between Mexico and the US significantly influence costs, consumer prices, supply chains, and job markets on both sides of the border. The future of bilateral trade relations remains dynamic, with political considerations, economic priorities, and global events shaping the trade landscape. Companies must adapt to this evolving environment by staying informed about policy changes, diversifying their supply chains, and exploring new markets to mitigate risks.

Businesses engaged in international commerce should leverage technology, optimize logistics, and form strategic partnerships to navigate the complexities of cross-border trade. These strategies will help companies turn the challenges of tariffs into opportunities for growth and success in the North American market. Flexibility and proactivity will position businesses to thrive in the face of changing trade dynamics.

Loyalty Logistics understands the challenges posed by tariffs and changing trade dynamics. Our expertise in cross-border shipping and commitment to efficient deliveries make us a valuable partner for businesses operating in the US-Mexico trade corridor. With our diverse fleet options (including refrigerated, reefer, and flatbed trucks) and advanced logistics solutions, we help companies adapt to the shifting landscape of international commerce.

Need Expert Guidance on Cross-Border Logistics?

Tariff impacts can be complex, but you don’t have to navigate them alone. Contact our logistics experts for personalized advice on optimizing your US-Mexico shipping strategy.